All eyes on merger and cost savings 👀👀👀

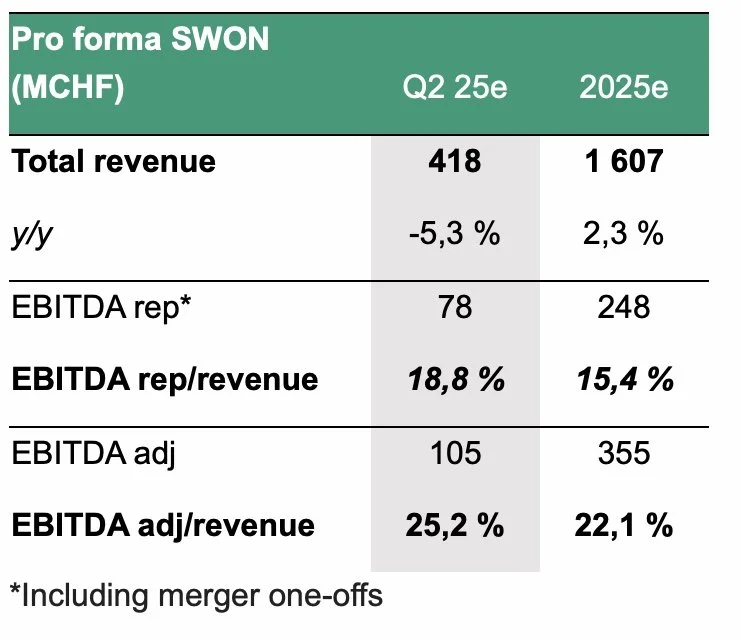

We expect SWONs growth at -9% growth (-5% in constant currencies) and Crayon at + 6% which leads to a proforma growth of -5%.

It’s not at all important for now.

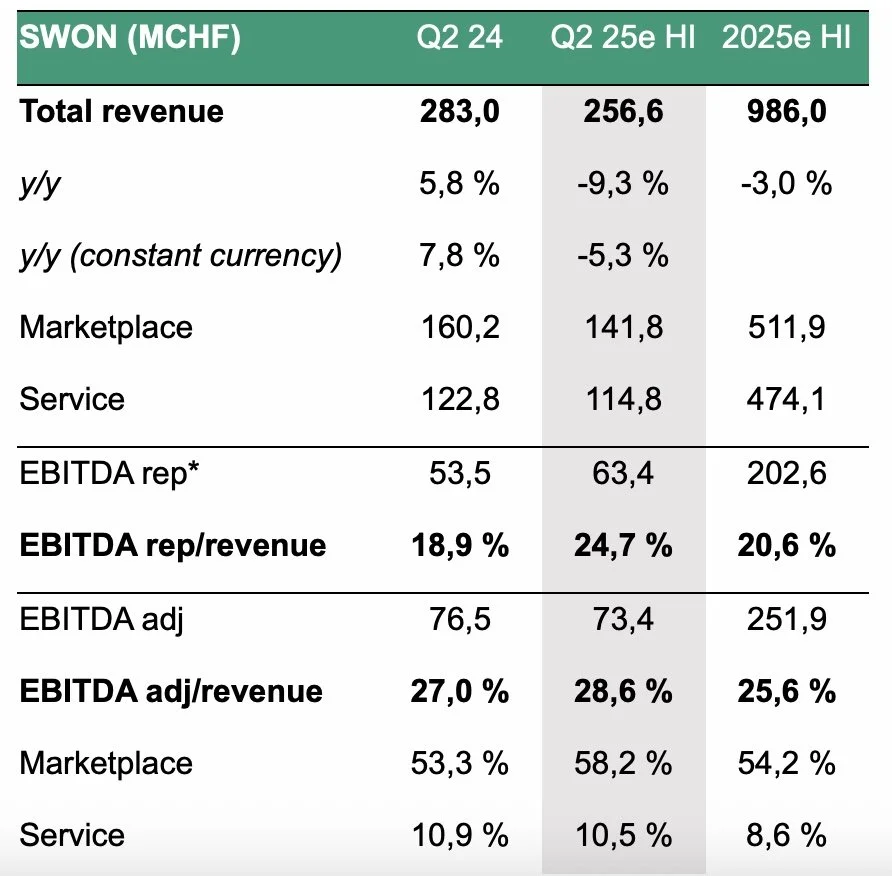

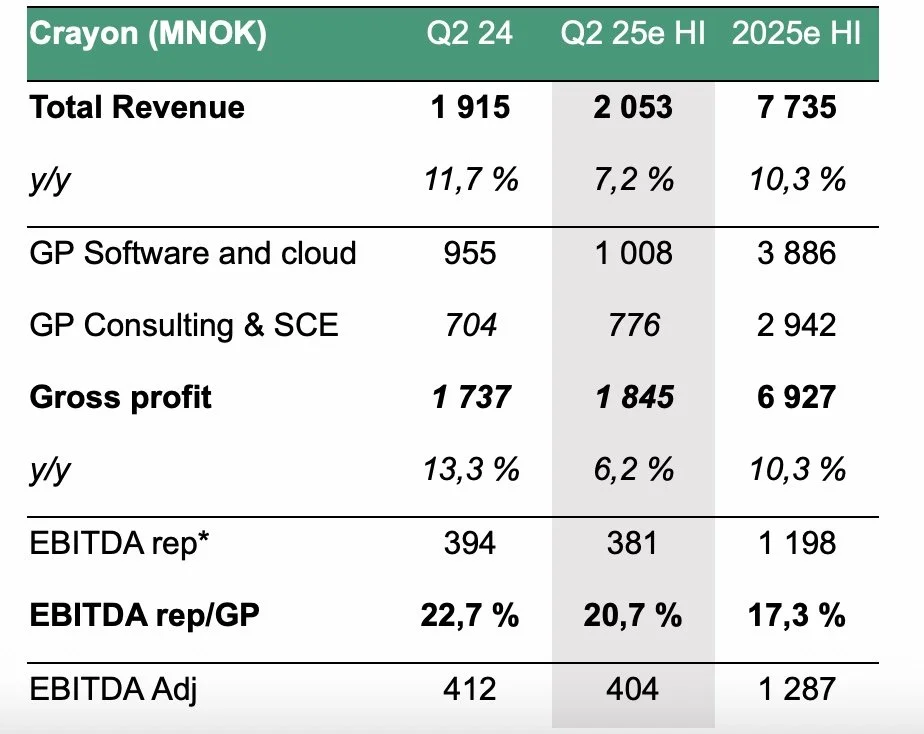

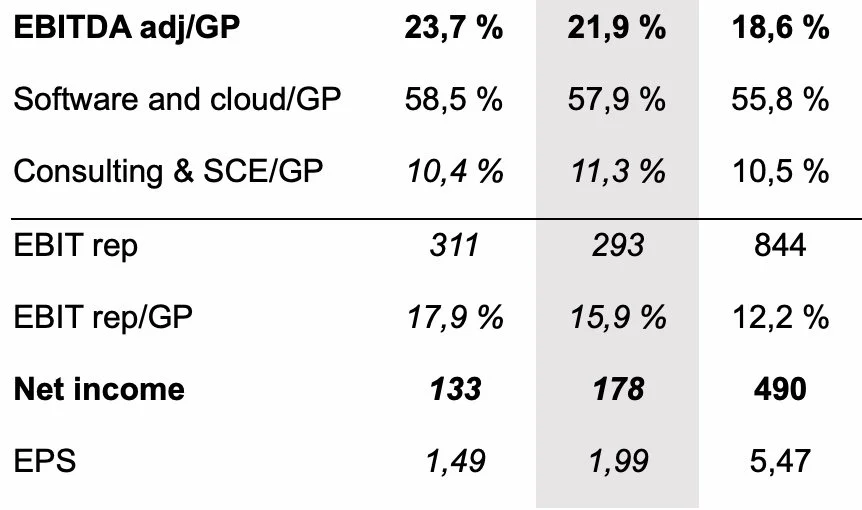

We have SWONs EBITDA adj/revenue at 28,6% and Crayons EBITDA adj/GP at 21,9%. Proforma you might see an EBITDA adj/revenue at 25,2%

It’s not very important for now but we’ll investigate figures and underlying realities in Q2 reporting.

All eyes are on merger Cost ambitions (guided at 80-100MCHF), one-offs (guided at 80-100MCHF), and more information about “how and when”.

We saw a very promising delivery in SWON on their present cost program in Q1, we expect that program to continue to deliver. Our LinkedIn tracker shows 157 FTEs reduced in SoftwareOne last 5 weeks which is an interesting datapoint waiting for Q2.

Costs and merger update is everything in this report. Confirmation on ambitions are “more than good enough” in our view.

Income synergies (if any) are too early to talk about.

Our 12 months target price at 11,1 CHF/140 NOK (unchanged) is based on a very conservative EV/EBITDA 2026e at 7x

If the marriage between “The Beauty and The Beast” 😊 progress well, you could see a very significant multiple expansion unfold the next 12 months.

SoftwareOne:

*Merger one-offs not included in company specific figures but is included in pro forma figures.

Crayon

*Merger one-offs not included in company specific figures but is included in pro forma figures.

Pro forma SoftwareOne

Stay tuned and have a look into our previous reports here. Here is the link to the original Beauty and the Beast.

Best regards,

David and Sverre

Hvaler Invest AS

Lillestrøm, Norway

26.08.25

Disclaimer:

Hvaler Invest is a significant shareholder so you cannot trust us (or perhaps you can?)