SoftwareOne vs Crayon - Any issues in the balance sheet?

SWON - is it any issues in the balance sheet?

In our latest letter we concluded that "adjustment" in P&L is "fake". They are at a very high level, fast growing and 10x the size of CRAYN adjustments.

Is it any other elements, like in the balance sheet, where SWON and CRAYN have different practices?

We have looked into the notes in annual reports for the last 5 years. In note 15 at page 176-178 (2023 report), we discovered something interesting. Let's put our balance findings into perspective;

· Working Capital, no issues

· Tangible assets, no issues

· Goodwill, no issues

· Other intangibles, no issues

· Internal software dev. significant issue

· Net Cash/debt not an issue now but …..

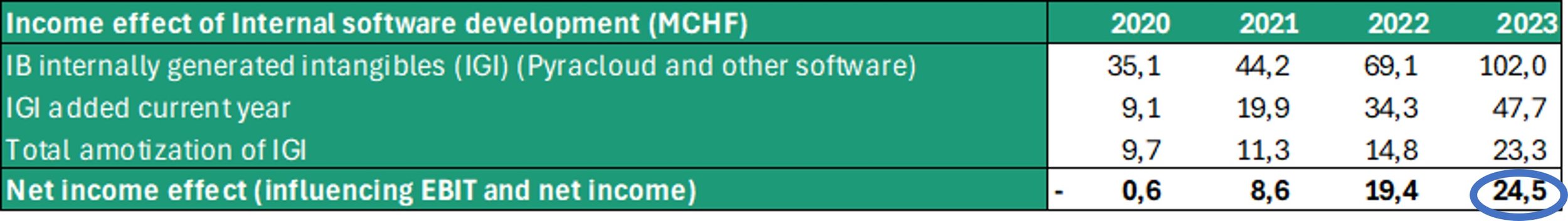

As you can see they improve 2023 Net Income and EBIT with 24,5 MCHF through a very high level of activated internal software development. The net income calculation is; 47,7 MCHF (added current year, meaning activated on balance sheet) – 23,3 MCHF (total amortization) =24,5 MCHF. The comparable net income figure in CRAYN (note 8, page 37 2023 annual report) is 2,1 MCHF which means you have a 12x bigger figure in SWON relative to CRAYN.

If you use a SWONs P/E multiple of 10x you end up with an increased market cap of 245 MCHF which is 25% of SWONs market cap (everything else equal).

Normally these activated IT costs are prudent and not an issue but here you see 4 things occurring at the same time;

i) the level is unusually high in nominal values

ii) it’s growing very fast

iii) the level is abnormal relative to peers (CRAYN)

iv) you can’t see any evidence in previous years figure that these investments improve efficiency and profitability

Reflect on these figures, do you think it's reasonable? We don't, not when CRAYN figures are a lot lower and you cannot see any evidence of improved efficiency in SWON last 3-5 years.

Early next week we'll travel to Switzerland together with other CRAYN shareholders and Petter Kongslie from SpareBank1 Markets (nr. 1 ranked IT analyst in Norway). We look forward to learning more and getting closer to a conclusion.

Stay tuned.

Disclaimer:

Hvaler Invest is a significant shareholder so you cannot trust us (or perhaps you can?)

All the best,

Sverre and David

Hvaler Invest AS

Lillestrøm, Norway

15.01.25