LINK Q4 — The Bigger Picture

After a disappointing Q4 with negative organic growth at 4% (that will lead to some volume challenges next 9 months) it's time to take a step back and reflect. First, let's agree that volatility is normal and it goes two ways. It's normally not structural neither on the upside nor on the downside every time results are surprisingly good or bad 🙂

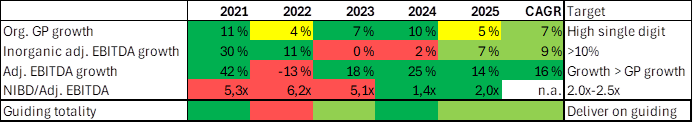

Here are facts last 5 years and guiding vs reported figures last 3 years

Note that company guiding has been "medium term" and not "annual" or "quarterly". Too many (short term oriented) people don’t really understand the difference 🙂

You can read 5 things from these facts - LINKs businessmodel works and management walk the talk 👍

Organic growth is high single digit (7% CAGR). It makes sense, it's a maturing market supported with a positive momentum from product development

Inorganic growth (M&A) builds value. Gross profit is up 11% in 2025 and will grow very quickly in 2026 (29%) due to SMS portal

Profits are growing a lot faster than volume due to scalability, accretive M&As and margin improvements

Net debt/EBITDA is now lower than target and leads to a strong M&As capacity

Management guiding credibility has been prudent

What about 2026?

Hvaler Invest expect:

Organic growth at 5% including organic growth in SMS portal, starting with negative growth in Q1 due to client losses in Q4 2025 and then gradually improving through the year since already signed contracts and new client wins will gradually kick in and comps get easier😅

Inorganic growth at 24% arriving mostly from SMS portal but we are including 1 new M&A (of 5 in due dill) in 2026👏

EBITDA/GP margins will increase dramatically (from 42% to 50%) due to SMS portal and margins will improve slightly also exclusive of SMS portal💰

Adjusted and unadjusted EBITDA/EBIT will skyrocket 🚀 and increase with some 50-110% in 2026. It's leading to an interesting entry point for 2027 😀

Net debt/EBITDA will be reduced during 2026 from 2.0x to 1.4x📉

We have recently been asked a few questions on whether Q4 setback was a part of a structural change where for instance “big tech” are going more directly towards LINKs clients. Our opinion is very simple, it’s “No”. There are 4 reasons why; i) LINKs volume is too small and heavily tilted towards telecom, ii) LINKs volume and profitability is heavily tilted towards the Enterprise segment (65.000 clients) that need both technical integration and advise on how to utilize next generation products, iii) why should Meta or others, with their highly scalable business, build distribution capacity in such a market. Remember, their product portfolio is also too narrow to take client control, iv) Google is dependent on telecom operators and cannot surpass those companies even if they wanted to.

It’s noise – let it go 😊

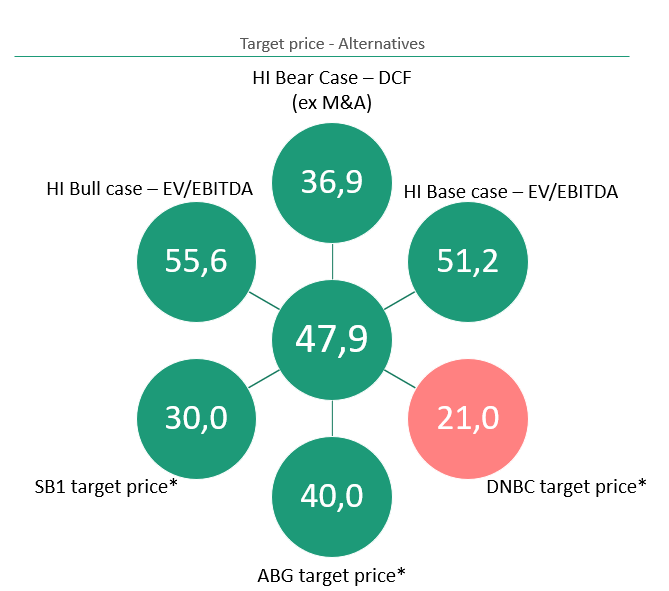

Our new target price is 47,9 (58)

Short term reduced organic growth, slightly lower margins, slightly slower entry of new M&As (we could be wrong here) and some preliminary multiple contraction leads to a reduced target price, but we think 38% share price drop after LINKs profit warning is almost equally stupid (🐑) as Crayons drop in Q3 2023 where we also saw a lot of shorting interest.

* Analysts does not include M&A

Analyst coverage

We find Eirik Rafdal (DnB Carnegie) comments 12.02.2026 amusing. In early morning communication, "After a 25% share price decline following last week's gross profit warning, we see limited additional downside" and 6 hours later he hammered down target price from 46 to 21😱 without a reasonable set of arguments (on the contrary actually). Let's remind you that DnB Carnegie had the same position on Crayon in Q3 23 and Crayon gave 61-77% ROI next 6-9 months (depending on period) and we earned a lot of money💰.

To predict "when" LINK start moving north again is difficult given an expected modest Q1, but Hvaler Invest increased from 4 Mill to 6 Mill shares after profit warning 🙂

It's still our opinion that we have a strong compounder in LINK and management walk the talk.

Best regards,

David and Sverre

Hvaler Invest AS

Lillestrøm, Norway

17.02.26

Disclaimer:

Hvaler Invest is a significant shareholder so you cannot trust us (or perhaps you can?)