New Target price 238 NOK up from 200 NOK

As stated earlier my previous 200 target price should be reached before November 2023. 200 before November is still valid, 238 will be reached half a year later.

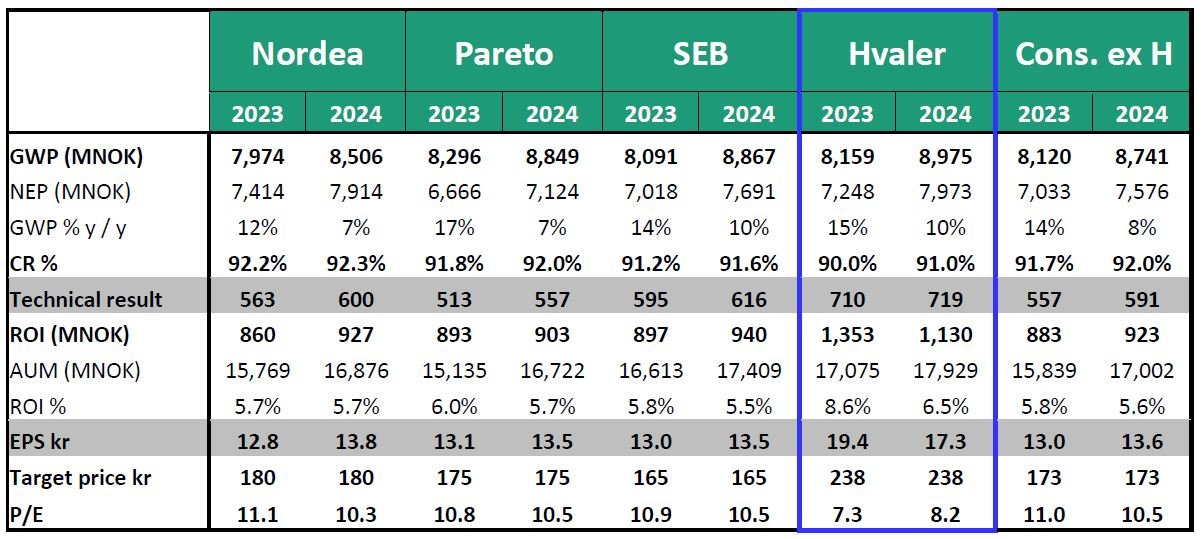

There are two reasons why we are in previous ”bull territory” and the target price is moving up. Growth is stronger (still disciplined and profitable) and interest rates have continued up (bond return moving north very very fast and return will last longer). If you look at my analyst update below you will see 4 interesting things;

Analysts are probably too conservative on volume (and Pareto is wrong on Earned premium)

Analysts are (again) far too conservative on investment return (bonds primarily). Upgrade next.

We basically agree on CR which makes sense since visibility have increased last years

Target prices from analysts, based on their own assumptions, are very low compared to peers.

Reasons to buy at any price below 200

ROE will be higher than HTD 20%, double digit profitable growth will continue, dividend capacity is good and investment return will be dramatically higher. My new intrinsic value ends up at 238 and my new bull scenario is at 292 (slightly higher growth and running yield and slightly lower CR). You may see a target price upgrade after Q2.

Investments is core business – peers are Berkshire Hathaway and Markel, not Gjensidige

Running yield in bond portfolio is 6% today and interest levels is still moving north. Further, the company has outperformed any peers both before and after insourcing of investments Q4 2014. Protector is dramatically better on bond investments than other investors. It’s proven. Losses last 7-8 years is 3-4 bp and return is far far better than DNB High yield (on high yield) or any other benchmark on investment grade. Equity return is impossible to evaluate properly, but do you honestly think Dag Marius (CIO) and his team suddenly will start delivering only 8% annually? You must be kidding. I do have 8% as an stupid assumption in my intrinsic value calculation (except for 2023 where I have 16% since 2023 have started out very well on equities already) but there’s obviously a significant upside in this assumption.

Protector is one of very few insurance companies in the world having ”Investments as core business”. You should look more towards Berkshire (insurance parts of) and Markel to understand and value Protector. Gjensidige with their ”risk free investment approach” is a totally different animal (I’m not saying bad – only different). Remember, Protector has delivered HTD 27% CAGR shareholder return where most of investment has happened when interest rate levels have been at a historical bottom. Now we are at a running yield 6% when we saw 2% 15 months ago.

Trading at a very significant discount to peers (share price 145)

Protector is currently trading at significantly lower prices relative to Nordic insurance peers. 30% CAGR shareholder return the next 2-3 years seems realistic.

Triggers and opportunities

You will probably see 4 triggers next 8 months.

• A very very strong eps in Q1 driven by a fantastic investment results

• 15% growth or higher in Q1 and the same in Q2

• A healthy Combined Ratio after H1 and a small uplift in running yield (if spreads are stable)

• A strong Q3 Combined Ratio and another uplift in running yield (if spreads are stable)

Share price will reach 200 in November and eyes will start looking towards 2024.

All in all, it’s my assumption that Protectors long term investor credibility will continue to grow, and repricing towards Nordic peers will happen.

Sverre Bjerkeli

Analyst trainee, Hvaler Invest AS

Lillestrøm, 05.03.2023