Our investments

Preview Q4 Protector Forsikring ASA – Base case Target price unchanged (200) - Buy

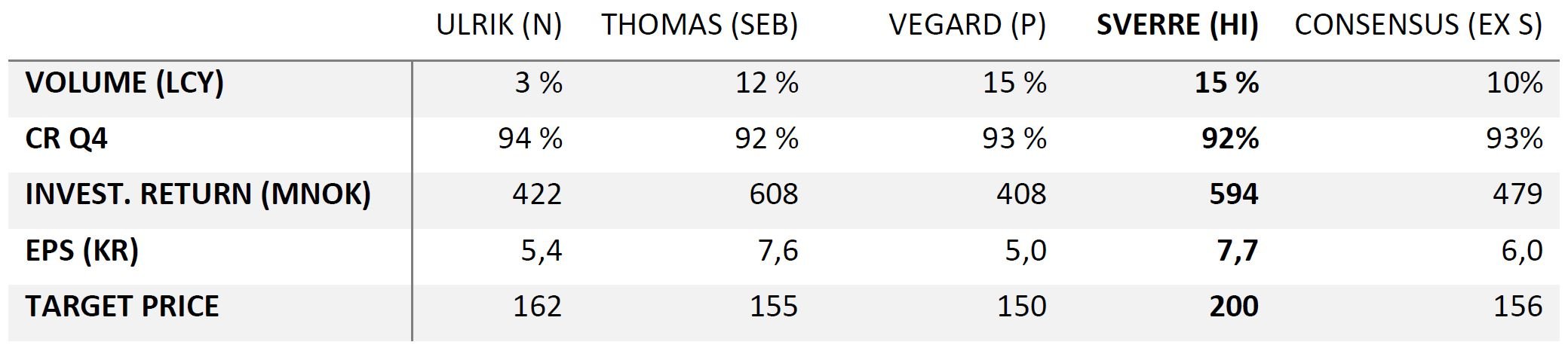

There are 3 things you should look for in Q4: volume, combined ratio, and investment return. In this preview I will also look at the three analysts covering Protector. So far, I have been better in Q2 and Q3 - probably beginner’s luck – let us check out Q4 and see whether I am lucky again. My base case assumptions (leading to share price 200) are volume growth 9%, CR 90%, and bond return 4% on an annual basis.

I have now done my Gorden Growth model and it ends up with an intrinsic value sized 216 kr . My peer comparison is now moving north of 200 (changes in bond return expectations) but will first be updated after Q4.

Volume (GPW): Let’s make it short. It will be double digit. My estimate is minimum 15% growth (LCY) in a relatively small quarter driven by price increases, low churn, new business in UK and a stable market share in Scandinavia. Look out for Protector’s announced January 1st premium update on Friday 20th.

Combined Ratio: My estimate in Q4 is 92%. Seasonality CR is higher in Q4 than Q2/Q3 but lower than Q1. Since there has been a “lot of weather” both in Scandinavia and in UK (Direct Line just sent out a profit warning linked to weather claims in UK in Q4) the risk is on the upside. Let’s see, it is not that important. The important thing is a 2022 CR somewhat below 90% including some reserve gains. I will update you on my 2023 expectations after Q4 but my base case assumption is still a long term CR at 90%.

Investment income in a quarter is not at all important, but when realities are different from expectations and consensus you can act on it. In Q4 realities are higher than consensus, and in my opinion also higher than market expectations. Market is stupid as always I know - you might think I’m stupid . Investment income will be as high as 594 MNOK in Q4 due to; 1) Equities performing better than any benchmark (close to 15%) 2) High running yield in portfolio (5.5% entering Q4 and growing through the quarter) and 3) Spread contraction of some modest 20 bsp in total. Remember, equities are free of tax, leading to a very low tax rate in Q4 and higher EPS than you think. Running yield is still moving north (interest rates continue up/time lag/spread contraction). My estimate now is 5.7%. The only company in the Nordic benefitting more from this bond hike is probably Storebrand (Buy). Again, my base case assumption leading to NOK 200/share is 4.0%, leaving a lot of room for interest rates to move down in 2024 and/or 2025 and later.

Summary and Question; Margin of safety buying Protector at 132 when 2023 multiples are far, far lower than peers despite growing faster every year (21% CAGR last 10 years and 15% in 2022). If I’m wrong your dividend yield next year will be 8% (share price 132), you can live with that – can’t you?

Disclaimer: I’m a significant shareholder and bought more in Q4, so you cannot trust me (or perhaps you can?)

Sverre Bjerkeli

Analyst trainee, Hvaler Invest AS

Lillestrøm, January 16th 2023